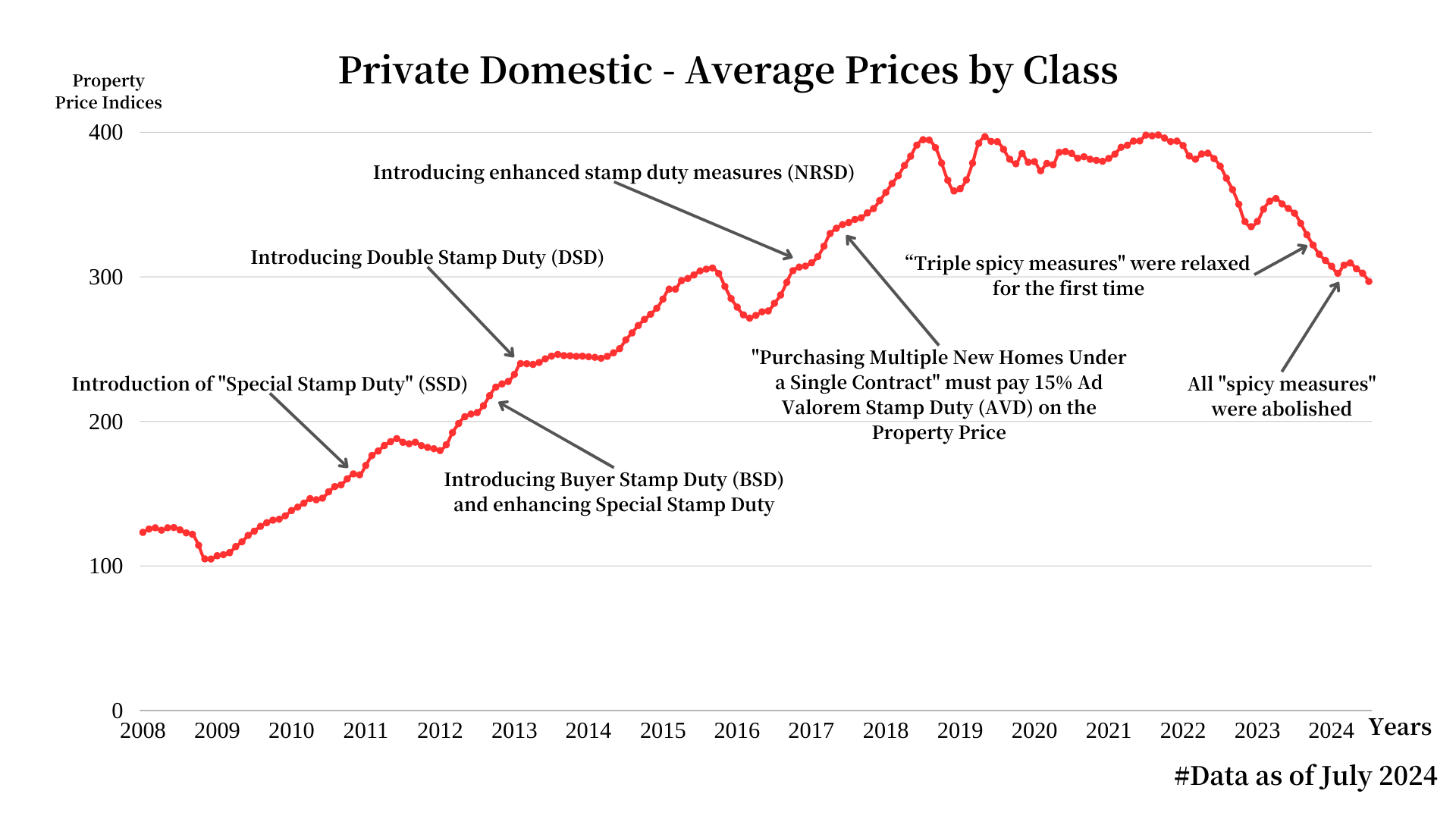

Dating back to 2010, the Government has emphasised the need for "extraordinary measures in an extraordinary time" when it announced a set of "Spicy Measures", referring to stringent property measures, for the property market. Against the background of a shortage of land supply and global quantitative easing, property prices surged and speculative activities grew. In response, the Government introduced a list of measures to suppress demand by increasing transaction costs.

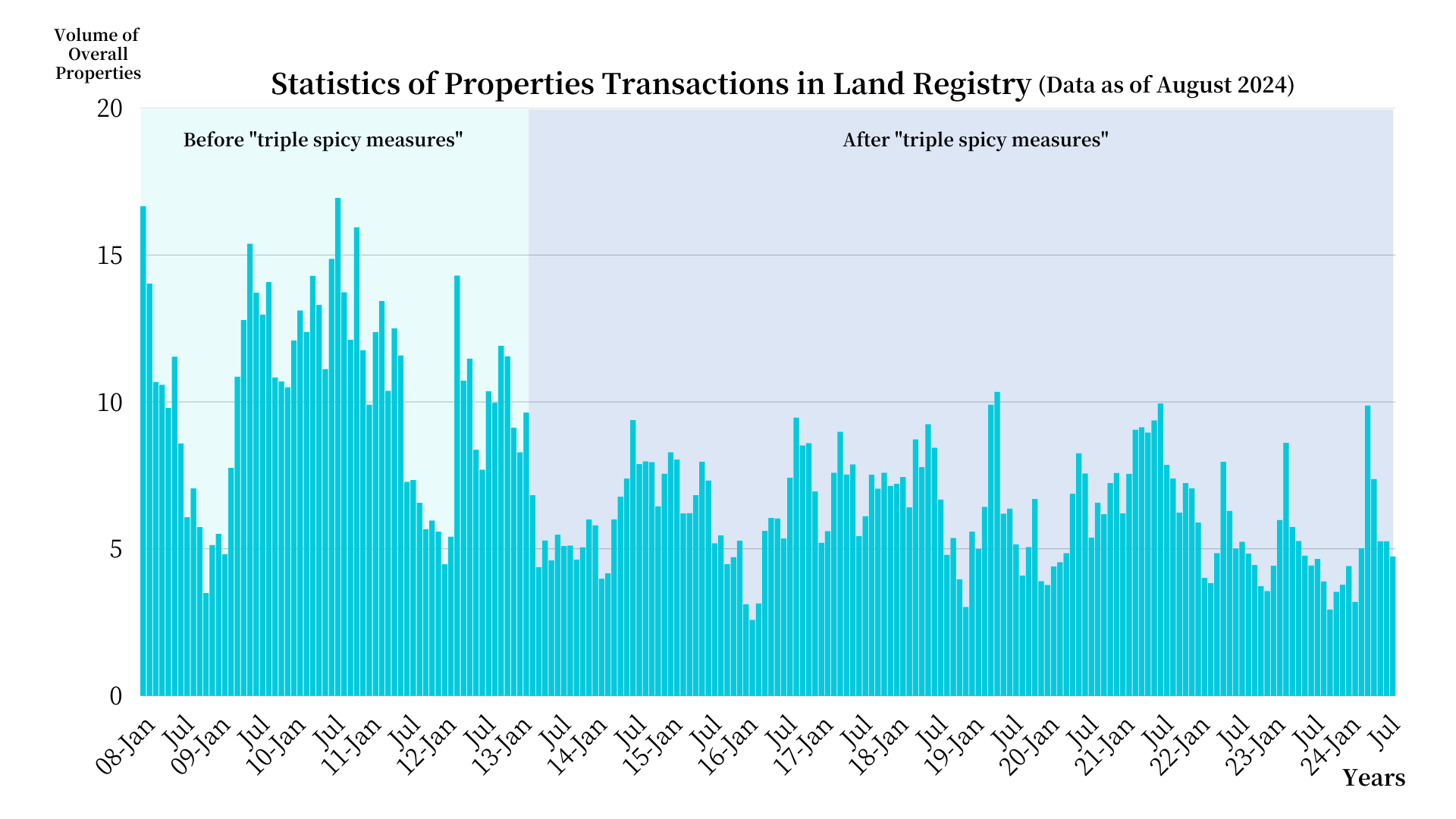

The Government has its own justifications for the stringent measures. When you don't have other options, you can only suppress demand. At the same time, you should try to solve land shortage and to speed up supply. But if you cannot solve land supply but continue to suppress demand, the result is a sharp fall in second-hand property transactions. The sale and purchase of residential flats were adversely affected. The "Spicy Measures" have therefore failed to achieve their expected effect. The measures have already been introduced for more than ten years. In whatever definition it may be, a period of over 10 years cannot possibly be considered as "an extraordinary time". It has become "a time of normalcy".

Over the years, I have persistently called for a full review in order to put the distorted market back on the right track. Otherwise, the "extraordinary measures" will become "normalised". Being the member who was the earliest one to have made a call for a total abolition of the "Spicy Measures", I am glad that the Government has finally heeded my advice and announced the abolition in late February 2024. The decision will help put the long-distorted property market back to normal, inject vitality to the economy and restore the confidence of citizens and investors.

On February 1, 2024, a motion debate on "Adjusting the policies on the stock and property markets to strengthen the impetus for growth" was tabled. I submitted an amendment motion calling for an immediate total abolition of the "Spicy Measures". Although my motion was not passed, a total of 45 members supported it. Only eight opposed. It showed my proposal had received broad support in the Council.

It took a long time for the Financial Secretary to finally admit in his Budget speech in 2024 that there was no longer a need to manage property demand in view of the economic environment. He announced all "Spicy Measures" would be scrapped immediately.

In a "Legislative Council Brief", the Government said "the removal of residential property demand management measures is expected to enhance market confidence and provide support to the property market". This is an understatement. The abolition not only helps increase supply in the second-hand residential market but alleviates the financial burden on local citizens seeking to buy another flat and foreigners who want to buy Hong Kong property.

With those measures scrapped, property developers do not have to first pay additional stamp duty before carrying out redevelopment. It will be conducive to urban renewal. Furthermore, the housing ladder of purchase of property will be rebuilt, facilitating the recovery of industries including property agents, legal services, banking and mortgages, renovations, furniture and appliances sales. The huge economic chain driven by the increase in property will help the overall economic recovery and enhance the well-being of citizens.

All "Spicy Measures" will be lifted. But what the Government did was to amend the stamp duty rate in Schedule 1 of the Stamp Duty Ordinance. The framework and related provisions of those "Spicy Measures" in the ordinance remain unchanged. This is because the Government hopes to keep them so that they can reintroduce those measures by adjusting the stamp duty rate if and when they found it necessary.

I think the only situation under which the Government may intervene in the market again is when its land and housing policies fail completely, causing a shortfall in supply and a hike in property prices. I can't help but ask why the Government lacks confidence in its own land and housing policies. Given the current number of completed and under-construction units, plus the land available from land sales and land exchanges, the supply of land is adequate in meeting the demand in the next few years. Taking into account the Government's subsidized housing supply, be it rental or sale, and long-term planning, we began to see the light at the end of the tunnel.

In addition, projects of new development zones, including the Northern Metropolis, North Fanling, North Kwu Tung, and Hung Shui Kiu, have also been launched. The Government is also easing urban redevelopment restrictions, which will further increase land supply. Only if none of these policies work, supply has already been secured otherwise. Why do we need to reintroduce stringent extraordinary measures? If the worst comes to worst, the Government should relentlessly strengthen governance to make sure the policies work, not to intervene in the market.

The Government introduced the first "Spicy Measures" in late 2010. It has taken 13 years for it to be totally abolished. It seems to me that the Government needed to spend 13 years to confirm some principles in economics. Take an example. Prices are determined by supply and demand. The original intent of the Government in introducing "Spicy Measures" was to suppress demand to buy time for an increase of supply. But prices will continue to go up if supply is still inadequate. Take another example. Oversupply of funds will inevitably spur investment demand. The loose monetary policy and ultra-low interest rates have inevitably made Hong Kong real estate a hot choice for investors.

Today, price adjustments are due to oversupply, rise in interest rates and weak market confidence in accordance with the same economics principle. The Government spent 13 years just to prove one thing: "market intervention through administrative measures does not work and, worse, is counterproductive."

In 1999, the Real Estate Developers Association of Hong Kong had commissioned Professor Richard Wong Yue-Chim of the Hong Kong Centre for Economic Research to conduct a study following speculation that the Government was preparing to introduce market intervention measures. The analysis in the research was very forward-thinking. Its conclusion read, "A reduction in demand will lower property market liquidity, thus increasing price risks. A decline in property prices will not only suppress the market but also harm the economy and slow growth. The impact of a fall in property value will also spread to the stock market. Asset losses will weaken businesses and financial institutions' balance sheets. The negative wealth effect caused by falling property prices will dampen consumer confidence and spending. Some families that use property and stock investments as collateral for loans will face financial difficulties. Government revenue will also drop sharply due to lower land prices and reduced real estate and stock market transaction volumes. The Government should adopt a steady increase in land supply to allow the market to function and adjust itself. Any misguided intervention will only bring risks to the market."

Economists are not prophets, nor am I. Even before becoming a legislator, I have persistently reiterated that "Spicy Measures" were intervening in the market. I have urged the Government to immediately drop them to revive the economy on the basis of some irrefutable principles in economics. The analysis in the 1999 report has proved to be true. I feel helpless and sad. I hope the Government will not repeat the same mistakes again. Hong Kong's economic success has been built by the hard work of Hongkongers from several generations. That could be destroyed overnight.

The total abolition of "Spicy Measures" is a significant milestone in the rebuilding of Hong Kong's economy. It also marks a perfect ending of my extraordinary journey. I was walking alone when I began the journey. Now, everyone was cheering happily. Let the past be a lesson for the future. I urge the Government to handle the economy with great care - just as the cooking of a small dish. Never let administrative measures distort the free market again.